Our lives are defined and shaped by the ups and downs, smiles and frown, and other contrasts that accompany us. Painful to say, but accidents and emergencies are inevitable in our lives. Luckily we can minimize their impact with quick access to cash.

You may ask, ‘what if I have no savings and have a bad credit history?’ Then you are in the right place. This article discusses the best same day funding loans and explains how to get them via iPaydayLoans with bad credit.

Table of Contents

Introducing Same Day Loans For Bad Credit Check History

As their name suggests, these are short-term loans accessible on the same day you apply for them. They are ideal for unexpected expenses, including utility payments, emergency repairs, medical bills, etc.

However, if you have a bad credit check history, most creditors may find it hard to lend you money. Such a record shows irresponsible financial management as it reflects personal information, current and previous credit accounts, and inquiries unless it has errors. It will have your public records, including bankruptcies, foreclosures, and liens indicating a bad financial past.

Banks, credit unions, etc., will pay little heed to your ability to repay the loan or the reasons behind your credit challenges, which is terrible without other same day emergency loan options. Fortunately, brokers like iPaydayLoans are the most lenient lenders that could turn a blind eye to your poor credit check background.

Best Same Day Loans Online For Bad Credit Check History

You stand a better chance of accessing same-day loans for bad credit check history online with a variety to choose from on iPaydayLoans. Here are common examples:

Payday Loans

Payday loans are short-term loans of small amounts provided by online lenders due on your next payday. Your ability to repay the loan determines the amount you qualify for. Often repaid within two to four weeks of receipt in a single payment, payday loans are a portion of your expected income.

Payday lenders emphasize a source of income more than pay stubs from your employer. That means the employed, unemployed, and self-employed qualify for the loan. Moreover, following the laws passed over the years to regulate high fees and interest rates, payday loans are now more affordable.

Min – Max amount: $50 – $35,000

Repayment period: One – 36 months

Collateral: No

Installment Loans

Installment loans are a fixed amount of money online lenders extend to be paid back in regular, equal installments over an agreed set of times. You can remit the payments in monthly, weekly, or bi-weekly installments.

This option is ideal when you have to cover large expenses quickly but are unsure of fully repaying it in a single payment. An example of installment loans is personal loans which you can use for emergencies like medical bills, home repairs, and consolidating debt. They are also available for mortgage and auto loans.

Min – Max amount: $50 – $35,000

Repayment period:

- One to 36 months for personal loans

- Two to seven years for auto loans

- 15 – 30 years for mortgages

Collateral: No

Title loans

Title loans require a lien-free asset and proof of ownership of the asset as collateral for the loan. Because they require collateral, they tend to be more lenient regarding creditworthiness. The collateral, usually a car, determines the loan amount and repayment period. Other requirements include a photo of the vehicle, a government-issued ID, and proof of income and residence.

Title loans have the least processing time because most lenders will not perform a hard credit check. That way, you can receive the loan amount in one business day, even if you have a bad credit check history or a low credit check. Title loans apply to SUV, RV, car, motorcycle, and property titles.

Min – Max amount: $50 – $35,000

Repayment period: One to 36 months

Collateral: Yes (The purchased asset, for example, car or real estate)

Why Opt For Same Day Loans Online For Bad Credit?

Easily accessible same-day loans online are the best if you have a bad credit check history. Other reasons that make same-day loans an attractive option are:

- Avoid borrowing from people.

You may not have to repay money borrowed from family and friends with interest. However, asking for one may involve awkward moments, strain your relationships, and breed contempt over time.

- You have a bad credit check history.

If that’s the case, it will limit your options with traditional lenders like banks who prioritize creditworthiness. Instead, you have better luck with same-day loan lenders who prioritize income over the contents of a credit report.

- Quick application process.

Same-day loans with bad credit are easily accessible at sites like iPaydayLoans, which has a simple three steps application process. Moreover, approval is within minutes, unlike the usual bank loan application process, which is tedious and open to disapproval.

- In case of an emergency.

Time is of the essence during emergencies, and the long, uncertain process applied by traditional lenders may not suffice. Same-day loans for bad credit are a godsend here due to their short approval time.

How To Access Same Day Loans For Bad Credit Check History

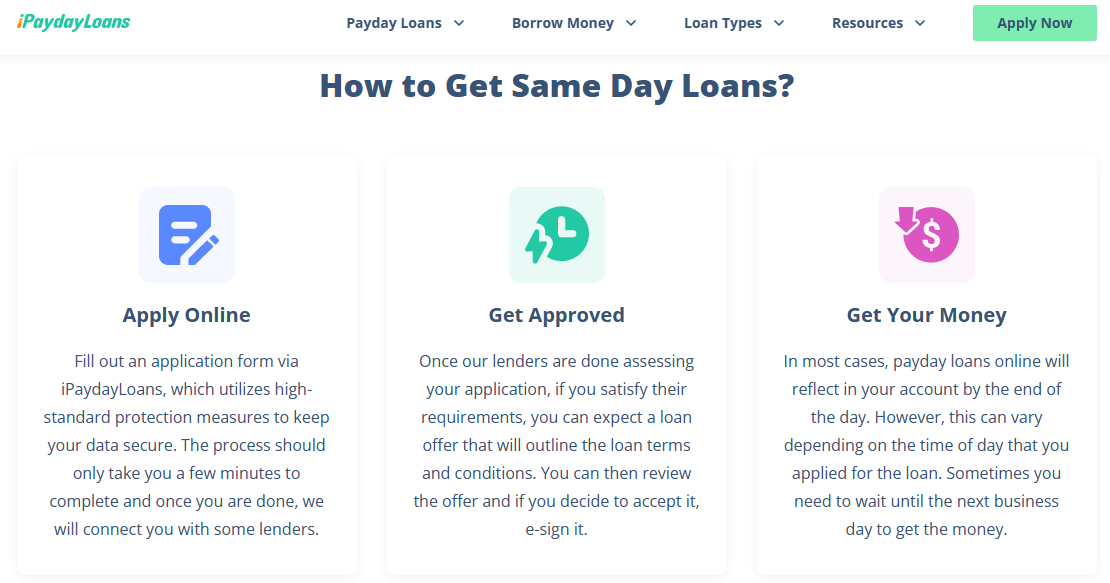

One such option where you can easily seek funding is the iPaydayLoans website in three quick steps:

- Submit the request.

Head to iPaydayLoans and click Get a Quote to fill out the online application forms with personal and banking details, then submit them to partner lenders for review.

- Wait for lenders’ feedback.

Interested lenders on iPaydayLoan’s network perform a soft credit history check to ascertain that you meet the basic requirements. These include proving that you are at least an 18+ years old adult with an active bank account, valid identification, and a source of income. If these check out, they send you loan offers.

- Receive your money.

Same-day loan approval typically takes as few as five to 15 minutes. Upon accepting an offer, they reflect in your account on the same day. However, depending on the time and day you applied, you may have to wait until the next business day.

Note: Ensure to read the lenders’ terms and conditions, as failure to abide by them could lead to penalties and extra late payment fees.

Maximizing Approval Chances For Same Day Loans Online

Even with high approval chances, you can hasten the process if you consider the following measures:

- Submit information to as many lenders as possible.

Casting your net wide increases your chances of approval and allows you to weigh options. And you will be worry-free about your data privacy if you are using iPaydayLoans, as lenders get your data after they approve your application.

- Be ready with the necessary documentation.

Come prepared with all the required documentation, including proof of a stable source of income, bank account, and US residency.

- Set time aside for the exercise.

The process should take less than an hour, including a few minutes to complete the application forms. Use the rest of your time reviewing the terms and conditions of the loan to avoid attracting penalties and extra fees.

Alternatives For Best Same Day Loans For Bad Credit Check History

There is no shortage of sites claiming to offer same-day loans for bad credit, but not all have legit lenders. Below are other valid alternatives to the iPaydayLoans site:

USBadCreditLoans

The USBadCreditLoans site offers same-day loans from trustworthy US lenders for people with bad credit. It has a quick, confidential, and secure application process that results in you getting funds within 24 hours or the next working day. Provide your income details, bank account data, and basic personal information to enhance your chances of qualifying.

HonestLoans

HonestLoans is another website to access same-day loans and other loans such as cash advance, personal, and emergency loans. The site, whose approval process is within minutes, provides loans of up to $50,000 as quickly as the next business day. What’s more, the site ensures the safety of your data with bank-level security using SSL encryption.

Final verdict

So you have no cause for wallowing in anxiety simply because of a bad credit check history. If you can’t access same-day funding loans from traditional lenders, you have flexible options to pick from online. Head over to the iPaydayLoans site to get funds when you need them the most without getting subjected to long waits and possible rejections.

Read: The Role of Artificial Intelligence in Modern Business Operations

Pranay, a coding maestro weaving digital magic with Dot Net,Angular. With 4+ years in web development,he specialize in crafting seamless solutions. Beyond coding, Pranay is a wordsmith, passionate about sharing insights through guest posts. Whether crafting code or narratives, he bring creativity and precision to every project. Connect to explore his coding journey and delve into the world where tech meets storytelling .follow us on X