Table of Contents

The Vendor Blind Spot Most Organizations Still Have

Firewall is available in most businesses. Majority of them have endpoint protection. However, inquire of them what security their top 20 vendors actually operate on and the room becomes silent.

That is what is wrong with the third party vendor risk assessment and management presently. It’s not a technology gap. It’s a visibility gap. It is now becoming more costly to turn a blind eye.

Verizon states that based on Data Breach Investigations Report 2024, approximately 15-percent of breaches are found to have an origin in-third party suppliers. Contextually, that is no round off error that is, it is one line of attack vectors as common as phishing itself. The SolarWinds breach did not involve breaking encryptions by targeting government networks. It entered through an established software supplier. The Target cyberattack began with the credentials of an HVAC contractor.

These weren’t edge cases. They were previews.

The article disaggregates what the TPRM landscape actually is today – the structures at play, the struggles that most teams continue to contend with, and the way trends are moving towards the year 2026 and beyond. This is also time well spent whether you are in the cybersecurity arena, that of compliance, the procurement side, or simply attempting to grasp the risk surface that your organization happens to be undertaking.

Vendor Security Evaluation Criteria: The Foundation You Can’t Skip

What “Due Diligence” Actually Means in Practice

Security assessment of vendors is not a check box process. When properly conducted, it is a systematic evaluation of the way a vendor manages information, how they control access, how they react to incidents, and the way they maintain themselves in terms of security over the long term.

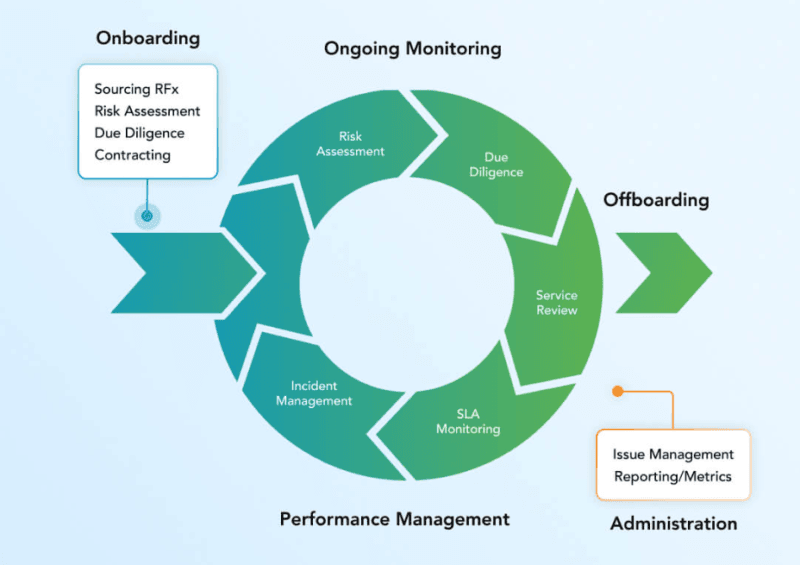

TPRM lifecycle (usually mentioned in NIST, ISO 27001 and DORA frameworks) operates in approximately five phases that include identification and onboarding, risk tiering, assessment, remediation, and offboarding. The first stage is moderately covered at most organizations. It is between stages three and five that things just get out of hand.

An effective vendor security measure will review:

- Access Scope: What information and systems do this vendor access? Are they containing any PII, payment information or accounts?

- SOC 2 Type II, ISO 27001 and CSA STAR are not meaningless security certifications. An attested survey in oneself is not enough.

- Vulnerability management practices How fast does the vendor fix known CVEs? Do they present an uncovered history of CVE?

- Subprocessor/Fourth-party transparency or visibility Who does your vendor depend on? Here lies Nth-party risk and it is often overlooked.

- Contractual obligations: Do the security requirements and breach notification schedules and audit privileges exist in the contract?

I have applied both lightweight and questionnaire-based solutions and cloud-based GRC platforms to conduct assessments, and the quality of output is considerable. Questionnaires tell their versions on what the vendors say. Constant surveillance applications inform you of what the vendors do.

Tiering Vendors by Risk – Not by Contract Size

Among the more enduring errors of evaluation of a vendor is their use of the same depth of evaluation to all vendors. The risk profile of a SaaS tool that is being used by two individuals in marketing does not on the same scale as a managed security provider having root access to your systems.

A realistic tiering model divides the vendors into three categories:

Tier 1 (Critical): Sensitive data or systems: direct access to them, major business dependency, or high regulatory exposure. These vendors receive complete audit, yearly reviews and continuous monitoring.

Tier 2 (Moderate): Limited access or indirect exposure to data. Lean evaluations, semi-annual evaluations.

Tier 3 (Low): Data access is either minimal or non-existent, can be easily replaced. Questionnaire that is shared on a standard basis, periodical spot visit.

Tiering does not decrease rigor – it focuses it where it is needed most.

Integration Risk Assessment: Where New Vendors Become New Attack Surfaces

The Hidden Complexity of Vendor Integrations

Each and every API connection, each particular data feed, each and every single sign-on integration between your systems and those belonging to a vendor is a potential opening. The assessment of the integration risk is the process of doing so which means the process of knowing and managing what happens at those connection points.

I observed that in most mid-sized organizations the integration risks are considered in their initial stage of onboarding and seldom considered again. That is an issue, as there is a change in integrations. APIs get updated. Permissions creep. Change of vendor infrastructure. A read-only connection in 2022 would have write-access nowadays since somebody made a support ticket what he/she wanted done in a quarter of a minute.

The important questions to be used in the integration risk assessment are:

- What are the data flows through this integration and in which direction?

- Are end-to-end data encryption and rest encryption possible?

- is there a rotation of the API keys, and scoping of permission to least privilege?

- Is the environment of the vendor in the same regulatory standards as yours (GDPR, HIPAA, PCI-DSS)?

- What becomes of data in the event of termination of a relationship with the vendor?

Software Supply Chain Security is also where it counts at this point. Whenever vendors put in place software updates, patches, or pieces of code in your environment (as SolarWinds did), each update can be used as an attack vector. Checking the quality of software delivery pipeline of a particular vendor is no longer a niche feature of large corporations. It’s baseline due diligence.

Shadow IT Compounds Integration Risk

Shadow IT Be it software or services that are not formally approved as IT at your company, Shadow IT silently increases your risk surface in integrating applications and services. SaaS tools are used to integrate to the core systems and bypass any formal security review, which business units tend to use.

According to the 2024 Global Cybersecurity Outlook of the World Economic Forum, 98 percent of the organizations said that at least one vendor-related data breach occurred in the last two years. That number is a large contributor by unmanaged integrations brought in by unauthorised tools.

Any vendor risk program should include discovery of shadow integrations – not a one time audit.

Incident Response: Vendor Compromise Scenarios

When the Breach Isn’t Yours – But the Damage Is

One of the more difficult incident types to prepare against is a vendor compromise since by definition, a compromise begins within your perimeter. You might not even know it is happening until the vendor becomes aware of it the vendor informs you or a scientist issues the data.

Majority within the incident response plans are designed to cater to intranet attacks. The vendor compromise situation necessitates a new playbook:

Detection triggers – What is the way that you know that a vendor is breached? The best is vendor notification that is usually delayed. Signals can be identified earlier through threat intelligence feeds, tracking the activities on the dark web and keeping the vendor security score to a high level.

Containment coverage– Does it have fast access control to the vendors on the integration side? This needs to know what is the actual access (back to integration risk assessment).

Data impact assessment What data was the vendor going through? In case a vendor gets breached, you must have to know in hours rather than in weeks whether your data customer was in-scope.

Notification schedules in regulation– under GDPR, a notifiable breach should be notified within 72 hours of the discovery thereof. By the state laws in the US, timings are different. The nature of your vendor contracts should identify notification of breach as being, at least, equivalent to your regulatory time frames.

Communication protocol Who should be aware, in what sequence in your organization? Collective notification is required in legal, executive leadership as well as affected business units.

I have observed that organizations which implement a documented vendor-specific IR runbook were identified to have vendor compromise incidents available at a quantifiably faster pace than organizations implementing generally-applicable IR plans in situ. The distinction is reduced to pre-charted access points and pre-programmed vendor contacts.

The Kaseya Incident as a Case Study

The ransomware attack on Kaseya VSA resulted in up to 1,500 businesses being the victims of the 2021 attack via a single managed service provider platform. It is one of the brightest instances of how the compromise of one vendor can be spread throughout a whole world of clients.

This betrayal of trust is what made Kasey so devastating, not only the technical exploit. MSPs were provided with the higher access to the environment of their clientele in order to control it. Such a trust turned into a breach point.

This is not the lesson that vendors should be distrusted. It is to limit trust, confirm it constantly and deal with its failure.

Continuous Vendor Security Monitoring: From Annual Reviews to Always-On

Why Point-in-Time Assessments Are No Longer Enough

Years ago annual assessments of the vendors were the rule. Send a survey, receive it, put it into records, do the same on the following year. The thing is that the risk of the vendors is not fixed. One could have a vendor who passes in January and receives a big breach in March.

Continuous vendor security oversight implies following vendor risk indicators on a near-real-time basis, such as:

- Security ratings– Security platforms such as bit sight and securityscorecard compile the magnitude of external indicators (open ports, health of an ssl certificate, history of breaches, botnet identifications) into a risk profile that is rated and updated continuously.

- Dark web surveillance – Searching leaked credentials, publicly available data or discussion of vendor systems on threat forums.

- Regulatory and financial health– A financially pressured or regulated vendor might compromise on security expenditures.

- CVE and patch tracking – Tracking Vendors to determine how well they are responding to disclosed vulnerabilities in their products and infrastructure.

I observed that teams that shifted to continuous monitoring where coming out of annual assessments, tended to discover the changes in risks that would have been non-existent in a point-in-time review – most of them within the initial 90 days of implementing a monitoring tool.

AI and Agentic Automation: The 2025–2026 Shift

This is where TPRM is really altering rapidly. AI-based solutions are starting to automate major parts of the vendor evaluation process – ingesting questionnaire answers, comparing them to external indicators, pointing out anomalies, and creating risk reports that would otherwise have required hours of work from analysts.

Multi-step actions This is beginning to emerge in TPRM platforms with agentic AI systems that are able to execute multi-step actions independently. The idea: an artificial intelligence agent that will be able to establish a vendor evaluation process, deploy questionnaires, process responses, and raise questions to be followed up based on the gaps, and have the possibility of leaving very little human intervention in the process.

This is not a convenience feature to organizations that deal with hundreds and thousands of vendors. It is the only logical road to coverage scale.

FAIR (Factor Analysis of Information Risk) is becoming popular, too, as a quantification model – the modeling of the conversion of qualitative red-amber-green ratings of vendors into financial exposure. This paradigm shift provides risk teams with the currency which is actually listened to by the stakeholders of the board levels.

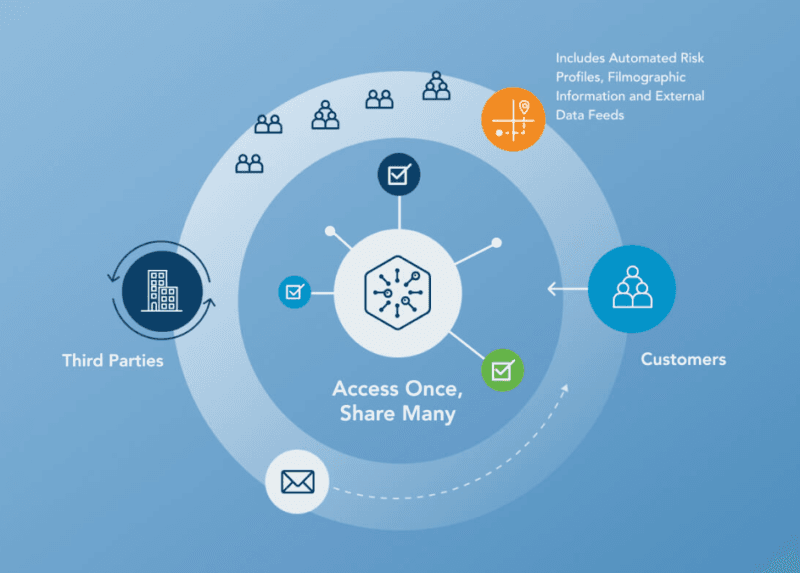

Shared Assessment Exchanges and the ESG Dimension

Redundancy has always been one of the points of friction in TPRM. Each client informs a different vendor about their questionnaire. The security team of the vendor takes weeks before responding to the identical questions of dozens of clients. Shared assessment programs are becoming increasingly popular where a vendor goes through a single standardized assessment and that the several devices are allowed to refer to such assessments.

The ESG factors are joining the TPRM discussion as well. Vendor environmental, social, and governance risk such as labor issues, environmental standards, and board governance are increasingly included in enterprise risk management, particularly when an organization has public sustainability pledges, or when it operates in a jurisdiction requiring global operations under regulatory regimes (e.g. the CSRD).

The Road Beyond 2026: What’s Just Beginning

Autonomous TPRM and Predictive Intelligence

It is probable that in the near future, third-party vendor risk assessment and management will be a less spearheaded program, more of a constantly running risk intelligence layer running through the enterprise.

Predictive ecosystem intelligence Predictive ecosystem intelligence ( Historial breach data, vendor behavior pattern, threat intelligence feeds, etc. ) is transforming as a research concept into a commercial product. There are already a number of platforms running prototypes of this ability.

Trust verification becomes a perusing topic by the use of blockchain: unchanging records of vendor certifications, audit findings, and compliance history that are verifiable without using vendor self-certification. It is premature, but the case is healthy.

There is also an increasing rate of converging TPRM with the wider enterprise risk management. Vendor risk does not exist in a vacuum besides operational risk, financial risk, or strategic risk. Companies developing integrated risk systems are starting to take vendor exposure as a first-tier input into the enterprise decision-making process – not an administrative responsibility handled independently in the security department.

Wrapping Up: The Program That Has to Keep Running

The third-party vendor risk assessment and management is no longer limited to spreadsheets and annual questionnaires. The frameworks are more developed. The tooling is more capable. The pressure of regulations is a fact and it is getting stronger.

However the same basic issue remains, your vendors are part of your risk surface and you hold the duty of knowing what that risk surface should look like, not only when you onboard them, but is an ongoing program.

The organizations that have this right do not necessarily have the largest security budgets. They are the ones who have transformed vendor risk into a structured, repeatable and continuous discipline and not a compliance exercise that occurs every once in a while. They are aware of the vendors that are crucial. They are familiar with what such dealers have access to. They also have a strategy on what to do in case of something wrong.

That’s the bar. And depending on the direction taken by the industry by the year 2026, then the industry will only be rising even higher.

I’m a technology writer with a passion for AI and digital marketing. I create engaging and useful content that bridges the gap between complex technology concepts and digital technologies. My writing makes the process easy and curious. and encourage participation I continue to research innovation and technology. Let’s connect and talk technology!